Introduction:

Digital payments have rapidly evolved over the past few years, transforming the way we conduct transactions. From the convenience of contactless payments to the decentralized promise of cryptocurrencies, the landscape of digital payments is set to continue its dynamic progression. This article explores the future of digital payments, highlighting the trends, technologies, and innovations that are shaping this sector.

The Evolution of Digital Payments:

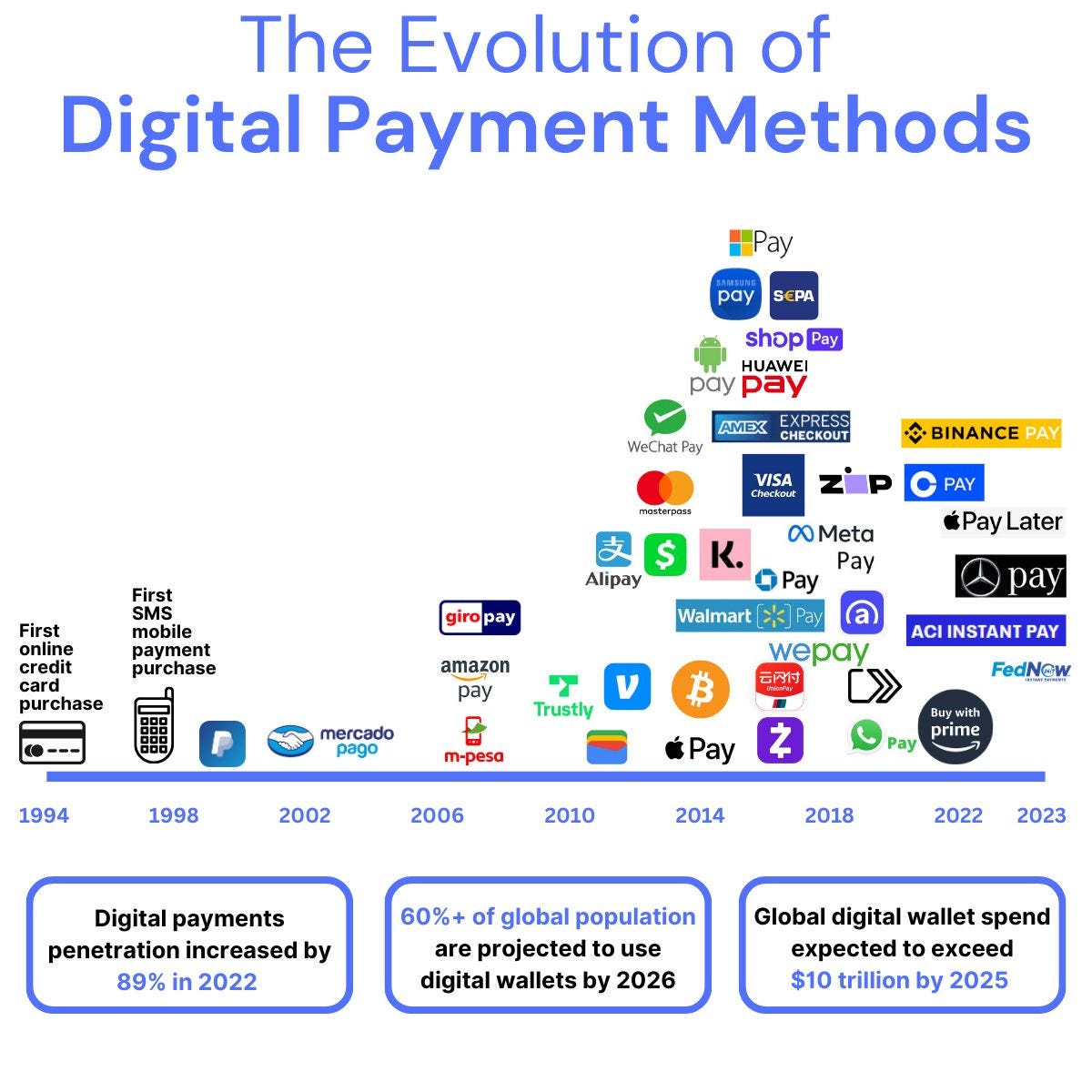

Digital payments have come a long way since the introduction of credit cards in the mid-20th century. The advent of the internet brought about online banking and e-commerce, setting the stage for a broader array of payment options. In recent years, mobile technology has further revolutionized the field, introducing mobile wallets and contactless payment systems that offer unprecedented convenience and security.

Early Beginnings

Credit cards, introduced in the 1950s, were among the first significant innovations in digital payments. They allowed consumers to make purchases without cash, paving the way for the development of electronic payment systems. The internet boom in the late 1990s and early 2000s introduced online banking and e-commerce, which brought about the need for secure online payment methods.

Mobile Payments and Contactless Technology

The rise of smartphones in the 2010s led to the development of mobile wallets like Apple Pay, Google Wallet (now Google Pay), and Samsung Pay. These platforms leverage near-field communication (NFC) technology to facilitate contactless payments, allowing users to make transactions by simply tapping their phones at point-of-sale terminals.

Contactless payment systems have grown rapidly in popularity due to their convenience and speed. According to a report by Juniper Research, the value of contactless transactions is expected to exceed $6 trillion globally by 2024, driven by increased adoption in retail and the continued integration of NFC technology in various devices.

The Rise of Cryptocurrencies

Cryptocurrencies represent a significant departure from traditional payment systems. They are decentralized digital currencies that rely on blockchain technology to provide secure, transparent, and immutable transaction records. Since then, thousands of alternative cryptocurrencies, or altcoins, have emerged, including Ethereum, Ripple, and Litecoin.

Advantages of Cryptocurrencies

- Decentralization: Unlike traditional currencies, cryptocurrencies are not controlled by any central authority, which reduces the risk of government interference and manipulation.

- Lower Fees: Cryptocurrency transactions often have lower fees compared to traditional banking and payment systems, especially for cross-border transactions.

Challenges and Adoption

Despite their potential, cryptocurrencies face several challenges that hinder their widespread adoption. These include regulatory uncertainty, price volatility, and scalability issues. However, recent developments, such as the introduction of stablecoins (cryptocurrencies pegged to stable assets like the US dollar) and advancements in blockchain technology, are addressing some of these concerns.

Major companies like Tesla, PayPal, and Square have begun to accept cryptocurrencies as a form of payment, signaling growing acceptance in the mainstream market. Central banks are also exploring the concept of central bank digital currencies (CBDCs), which could further legitimize and stabilize the use of digital currencies.

Innovations Shaping the Future of Digital Payments

The future of digital payments will be defined by continuous innovation and the integration of emerging technologies. Here are some key trends to watch:

- Biometric Authentication

Biometric authentication methods, such as fingerprint scanning, facial recognition, and voice recognition, are becoming increasingly common in digital payment systems. These methods offer enhanced security and convenience, reducing the risk of fraud and making it easier for users to authenticate transactions.

- AI and Machine Learning

Artificial intelligence (AI) and machine learning are playing a crucial role in enhancing the security and efficiency of digital payment systems. These technologies are used to detect and prevent fraudulent activities, analyze spending patterns, and provide personalized financial services to consumers.

- Integration of the IoT

The Internet of Things (IoT) is expanding the possibilities for digital payments by enabling connected devices to facilitate transactions. For example, smart refrigerators can automatically reorder groceries when supplies run low, and connected cars can pay for fuel or tolls without human intervention.

- Cross-Border Payments

The demand for faster, cheaper, and more transparent cross-border payment solutions is driving innovation in this area. Blockchain technology and cryptocurrencies are poised to revolutionize cross-border transactions by reducing the time and cost associated with traditional banking systems.

- Digital Identity Solutions

Digital identity solutions are essential for secure and seamless digital payments. These solutions use blockchain and biometric technologies to provide users with a secure and verifiable digital identity, reducing the risk of identity theft and fraud.

- Central Bank Digital Currencies (CBDCs)

Central banks worldwide are exploring the concept of CBDCs as a way to provide a stable and secure digital currency. CBDCs could enhance financial inclusion, reduce transaction costs, and provide a new tool for monetary policy implementation.

The Role of Regulation

As digital payment technologies evolve, regulatory frameworks must adapt to ensure security, privacy, and consumer protection. Governments and regulatory bodies are working to develop guidelines and standards for emerging payment systems, addressing issues such as anti-money laundering (AML), know your customer (KYC) requirements, and data privacy.

Global Collaboration

Given the borderless nature of digital payments, international cooperation is essential for creating a harmonized regulatory environment. Organizations like the Financial Action Task Force (FATF) and the International Monetary Fund (IMF) are working with countries to develop global standards and promote best practices.

Balancing innovation and regulation

Regulators face the challenge of balancing innovation with the need for security and stability. Overly stringent regulations can stifle innovation and limit the benefits of new technologies, while insufficient oversight can lead to increased risks and vulnerabilities. A balanced approach is crucial for fostering a secure and vibrant digital payment ecosystem.

Conclusion

The future of digital payments is bright, with innovations in cryptocurrencies, contactless payments, biometric authentication, AI, IoT, and CBDCs set to transform the way we conduct transactions. While challenges remain, including regulatory hurdles and security concerns, the potential benefits of these technologies are immense. As the digital payment landscape continues to evolve, it will be essential for stakeholders, including businesses, consumers, regulators, and technology providers, to collaborate and adapt to the changing environment.