Introduction:

The fintech landscape is evolving rapidly, driven by technological advancements, changing consumer preferences, and regulatory developments. As we look ahead to 2024, several game-changing fintech innovations are poised to reshape the financial sector, offering new opportunities for businesses and consumers alike. In this blog, we’ll explore the transformative fintech trends that are set to make waves in the year 2024.

In the ever-evolving landscape of financial technology (fintech), innovation is the name of the game. As we step into 2024, the fintech sector is on the brink of revolutionary changes that promise to reshape how we interact with money, investments, and financial services. Let’s explore some of the game-changing fintech innovations that are set to redefine the industry in the year ahead.

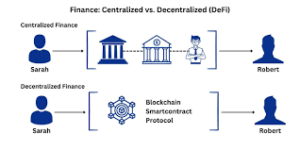

Ecosystem Expansion Decentralized Finance (DeFi):

Emerged as a disruptive force in the financial industry, Decentralized finance (DeFi) offering innovative solutions for lending, borrowing, trading, and asset management. In 2024, we can expect the DeFi ecosystem to continue expanding, with the introduction of new protocols, products, and services. DeFi platforms will increasingly bridge traditional finance with blockchain technology, unlocking new opportunities for financial inclusion and democratizing access to financial services.

Building upon the foundations laid by the first wave of decentralized finance, DeFi 2.0 is poised to unlock even greater potential. With advancements in blockchain technology, DeFi platforms are becoming more scalable, interoperable, and user-friendly. Smart contracts will enable a wider range of financial instruments, from lending and borrowing to derivatives trading, all without the need for traditional intermediaries.

Central Bank Digital Currencies (CBDCs) Adoption:

Central banks around the world are exploring the potential of central bank digital currencies (CBDCs) as a means to modernize payment systems, enhance financial inclusion, and address emerging challenges in the digital economy. In 2024, we may see an acceleration in the adoption of CBDCs, with more countries piloting or launching their own digital currencies. CBDCs have the potential to streamline cross-border payments, reduce transaction costs, and improve financial stability. In 2024, AI-driven financial management platforms will offer hyper-personalized insights and recommendations tailored to each user’s unique financial situation and goals.

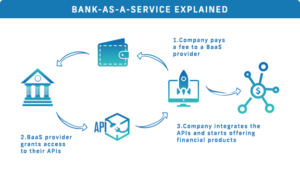

Embedded Finance and Banking as a Service (BaaS):

Embedded finance, also known as banking as a service (BaaS), is revolutionizing the way financial services are delivered and consumed. By integrating financial products and services into non-financial platforms and applications, businesses can offer seamless, personalized financial experiences to their customers. In 2024, we can expect to see a proliferation of embedded finance solutions across various industries, from e-commerce and gig economy platforms to healthcare and transportation.

Embedded finance is blurring the lines between traditional financial services and everyday activities. In 2024, we’ll witness a surge in embedded finance solutions integrated into various non-financial platforms, such as e-commerce, ride-sharing, and social media. From seamless payments to personalized lending options, embedded finance will streamline transactions and enhance user experiences.

Machine Learning (ML) in Financial Services: and Artificial Intelligence (AI)

Artificial intelligence and machine learning technologies are transforming every aspect of the financial services industry, from customer service and risk management to fraud detection and investment analysis. In 2024, we anticipate further advancements in AI and ML algorithms, enabling more accurate predictions, personalized recommendations,

and automation of routine tasks. Financial institutions will leverage AI-powered insights to enhance customer experiences, optimize operations, and drive growth.

From budgeting and savings advice to investment strategies, AI will empower individuals to make smarter financial decisions.

Green Finance and Sustainable Investing:

As environmental, social, and governance (ESG) considerations become increasingly important for investors and regulators, green finance and sustainable investing are gaining momentum. In 2024, fintech innovations will play a crucial role in advancing sustainable finance initiatives, including the development of ESG scoring models, impact investing platforms, and carbon offset solutions. Fintech firms will empower investors to align their portfolios with sustainability goals while driving positive environmental and social impact.

With growing concerns about climate change and sustainability, green fintech is gaining momentum. In 2024, we’ll see the emergence of innovative fintech solutions aimed at promoting environmental sustainability and combating climate change. From green investment platforms to carbon footprint tracking tools, green fintech will empower individuals and businesses to align their financial activities with their environmental values.

Open Banking and Data Sharing:

Open banking initiatives are reshaping the financial ecosystem by enabling secure data sharing among financial institutions, third-party developers, and consumers. In 2024, open banking frameworks will continue to evolve, fostering greater competition,

innovation, and collaboration within the industry. We can expect to see new use cases for open banking data, such as personalized financial wellness tools, alternative credit scoring models, and enhanced fraud prevention measures.

RegTech and Compliance Automation:

Regulatory technology (RegTech) is becoming indispensable in an increasingly complex regulatory environment. In 2024, RegTech solutions powered by artificial intelligence and machine learning algorithms will automate compliance processes, reducing costs

and mitigating risks for financial institutions. From anti-money laundering (AML) to know-your-customer (KYC) procedures, RegTech will revolutionize regulatory compliance.

and mitigating risks for financial institutions. From anti-money laundering (AML) to know-your-customer (KYC) procedures, RegTech will revolutionize regulatory compliance.

Cybersecurity and Fraud Prevention:

As the fintech sector continues to grow, so do cybersecurity threats and fraud risks. In 2024, cybersecurity will remain a top priority for fintech companies, leading to advancements in fraud detection and prevention technologies. From biometric authentication to AI-driven anomaly detection, fintech firms will employ cutting-edge security measures to safeguard user data and financial assets.

Digital Assets and Tokenization:

The rise of digital assets and tokenization is democratizing access to investment opportunities like never before. In 2024, we can expect to see a proliferation of tokenized assets, including real estate, stocks, commodities, and even artwork. Blockchain technology will facilitate fractional ownership, enabling investors to diversify their portfolios with ease and efficiency.

Conclusion:

The year 2024 promises to be an exciting time for fintech innovation, with transformative technologies and trends reshaping the financial sector. From decentralized finance and central bank digital currencies to embedded finance and sustainable investing, these game-changing innovations hold the potential to drive positive change and unlock new opportunities for businesses and consumers alike. As fintech continues to disrupt traditional finance, collaboration, adaptability, and a focus on customer needs will be key to success in this dynamic landscape.

From decentralized finance and AI-powered financial management to digital assets and embedded finance, these innovations will empower individuals and businesses alike to navigate the evolving financial landscape with confidence and agility.