Introduction:

In today’s rapidly evolving financial landscape, family offices are turning to technology to streamline operations, enhance efficiency, Traditionally, family offices have operated with a focus on personalized service and discretion. However, in today’s fast-paced and complex financial landscape, the need for efficiency, transparency, and scalability has become increasingly important.

And better serve their clients. From advanced data management systems to sophisticated client relationship tools, the right technology solutions have the power to revolutionize how family offices operate. In this blog, we’ll explore the transformative role of technology in modernizing family office operations and delivering superior service to clients.

In today’s rapidly evolving financial landscape, family offices are turning to technology to streamline operations, enhance efficiency,

This is where technology comes into play, offering innovative solutions to streamline operations and drive growth. In this blog post, we’ll explore how the right technology can transform how family offices operate.

The SaaS solution for family offices:

A SaaS (Software as a Service) solution for family offices would ideally cater to the unique needs and requirements of managing wealth and assets for affluent families. Here are some core aspects such a solution might cover:

Portfolio Management: Offer tools for comprehensive portfolio management, including asset allocation, performance tracking, risk analysis, and reporting. Customizable dashboards could provide a holistic view of all investments, including equities, real estate, private equity, and alternative investments.

Financial Reporting and Consolidation: Provide robust financial reporting capabilities tailored to the needs of family offices, including multi-currency support, consolidation of diverse assets, and generation of detailed financial statements. The solution should offer flexibility in generating reports for different stakeholders, such as family members, advisors, and regulators.

- Data Management and Analytics:

Central to the success of any family office is the ability to effectively manage and analyze vast amounts of financial data. With the right technology solutions in place, family offices can streamline data management processes, consolidate information from multiple sources, and gain actionable insights through advanced analytics. From portfolio performance tracking to risk management and compliance reporting, technology enables family offices to make informed decisions and drive better outcomes for their clients.

Effective data management lies at the heart of successful family office operations. With the right technology solutions, family offices can centralize and organize vast amounts of financial data, including investment portfolios, transaction records, and client information.

- Investment Management Platforms:

Investment management lies at the heart of family office operations, encompassing a wide range of asset classes, investment strategies, and risk profiles. Modern technology platforms offer robust investment management solutions tailored to the unique needs of family offices, providing tools for portfolio construction, asset allocation, and performance monitoring. With integrated trading capabilities and real-time market data, these platforms empower family offices to execute trades efficiently and seize investment opportunities as they arise.

- Enhancing Client Relationship Management:

Maintaining strong relationships with clients is essential for family offices to provide personalized service and build trust. Technology solutions such as client relationship management (CRM) software enable family offices to manage client interactions, track preferences, and streamline communication. By leveraging CRM tools, family offices can deliver tailored advice, anticipate client needs, and strengthen client engagement, ultimately enhancing client satisfaction and loyalty.

Building and maintaining strong relationships with clients is paramount for family offices. CRM systems equipped with advanced features such as customizable dashboards, client segmentation, and communication tools enable family offices to enhance client engagement and satisfaction.

- Cybersecurity and Data Privacy:

In an era of increasing cyber threats and data breaches, cybersecurity is a top priority for family offices tasked with safeguarding sensitive financial information. Advanced cybersecurity solutions offer multi-layered protection against cyber threats, including malware, phishing attacks, and ransomware. Encryption protocols, access controls, and secure communication channels help family offices mitigate cybersecurity risks and ensure compliance with data privacy regulations.

As custodians of sensitive financial information, family offices must prioritize cybersecurity and data protection. Technology solutions such as encryption, multi-factor authentication, and intrusion detection systems help safeguard client data and mitigate cyber threats.

- Automating Routine Tasks and Workflows:

Automation technology streamlines routine tasks and workflows, enabling family offices to operate more efficiently and focus on value-added activities.

By automating processes such as account reconciliation, document management,and compliance reporting, family offices can reduce manual errors, minimize administrative burdens, and improve productivity. Automation also frees up time for staff to focus on strategic initiatives and client-facing activities, driving innovation and growth.

By automating processes such as account reconciliation, document management,and compliance reporting, family offices can reduce manual errors, minimize administrative burdens, and improve productivity. Automation also frees up time for staff to focus on strategic initiatives and client-facing activities, driving innovation and growth.

- Outsourced Solutions and Cloud Computing:

Family offices can leverage outsourced solutions and cloud computing services to enhance flexibility, scalability, and cost-effectiveness.

Cloud-based technology platforms offer secure access to data and applications from anywhere, enabling family office staff to work remotely and collaborate effectively across geographies. Outsourced solutions, such as accounting, tax planning, and compliance services, allow family offices to focus on their core competencies while leveraging external expertise to support business operations.

Cloud-based technology platforms offer secure access to data and applications from anywhere, enabling family office staff to work remotely and collaborate effectively across geographies. Outsourced solutions, such as accounting, tax planning, and compliance services, allow family offices to focus on their core competencies while leveraging external expertise to support business operations.

- ESG Integration and Impact Investing:

Environmental, social, and governance (ESG) factors are increasingly influencing investment decisions and shaping the investment landscape. Technology solutions equipped with ESG integration capabilities enable family offices to identify sustainable investment opportunities, assess ESG risks, and measure impact across portfolios. By incorporating ESG criteria into their investment processes, family offices can align their investment strategies with their values and contribute to positive social and environmental outcomes.

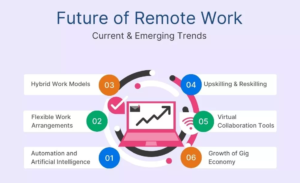

- Embracing Remote Work and Collaboration:

The rise of remote work has accelerated the adoption of collaboration tools and virtual communication platforms within family offices.

Technology solutions such as  conferencing, project management software, and virtual data rooms enable seamless collaboration among distributed teams, advisors, and clients. Remote work technology enhances flexibility, improves productivity, and ensures continuity of operations, even in challenging circumstances.

conferencing, project management software, and virtual data rooms enable seamless collaboration among distributed teams, advisors, and clients. Remote work technology enhances flexibility, improves productivity, and ensures continuity of operations, even in challenging circumstances.

Conclusion:

In conclusion, the right technology has the power to transform how family offices operate, enabling them to enhance efficiency, transparency, and scalability while delivering superior client experiences. By harnessing the capabilities of data management and analytics, investment management platforms, CRM systems, cybersecurity solutions, cloud computing, and ESG integration, family offices can navigate the complexities of the modern financial landscape with confidence and agility.

Stay tuned for more insights and updates on how technology is reshaping the future of family office operations!